What’s New In Taxes?

Telling Tips is a series of articles from local experts to help you save money, make better decisions and plan for a better future.

Need your tax return information? Get it right here. If you are looking for your prior year tax information, you have three choices:

- A Tax Return Transcript: This shows most of the line items on your originally filed tax return, including any forms and schedules. It does not show any changes made to your tax return after filing. Cost: Nothing. Available for current and last three year.

- A Tax Account Transcript: This shows your marital status, type of filed return, adjusted gross income, taxable income, and any changes made to your tax return after filing. Cost: Nothing. Available for current and last three year.

- Your Tax Return: This is an exact copy of the tax return you filed, all attachments, and your W-2. Cost: $50 (down from $57). Available for current and past six years. Note that for anyone living in an area designated as a disaster area (i.e. Superstorm Sandy), there is no fee.

Did You Receive The NYS STAR Letter?

True or False: New York State is concerned that you, as a homeowner, are not receiving the STAR property tax exemption.

False: This exemption is only available for the primary residence, and only if the combined income of the owner(s) and spouse(s) is no more than $500,000. Some residents have been claiming the exemption, which is worth $700 on average, for multiple properties. Local assessors will now have access to the other 1,000 localities statewide.

The registration applies only to the Basic STAR. Senior citizens receiving enhanced STAR are not impacted.

Miss Your Pet?

New York now allows cremated animal owners to be buried beside their beloved pets in a pet cemetery.

Low Pay For Fast-Food Employees

FYI: In a state-by-state breakdown, 60 percent of New York’s fast-food employees supplement their living costs with food stamps, Medicaid, etc, costing taxpaying New Yorkers $708 million, second only to California.

New York Lap Dance Customers Feel A Pinch

An argument that lap dances deserve the same sales tax exemption as dramatic or musical arts performances was decided in favor of the sales tax department. Sales tax will now be added. And remember, “sex therapy” is not a medical deduction.

File Your Tax Return Early – File Your Tax Return Early – File Your Tax Return Early –

Oops, sorry. The IRS won’t be open until between January 28 and February 4, instead of January 21 due to:

A) The October 16 day shutdown (Didn’t this happen last year too?), or

B) The IRS is putting a higher priority on ObamaCare.

What do you think?

Not Much Of A Surprise

An investigation states that the IRS has paid out over $110 billion of your tax dollars in the form of tax credits to people who didn’t qualify for them over the past 10 years. These funds were paid under the Earned Income Tax Credit (EITC) program. This program is intended for poor working families but, apparently, has been hijacked by unscrupulous tax preparers, the complexity of the form, and unsupervised mid-level IRS employees. (Maybe the IRS shouldn’t be in charge of wealth-redistribution programs.)

The New $100 Bill

- It’s been delayed since 2011 due to a crease during printing, which left blank spaces on the bills.

- The cost for each bill is 12.6 cents, versus 7.8 for the old ones. This is the price to combat counterfeiting and for the ability to authenticate easier.

- Ben Franklin is still on the front, and Independence Hall is still on the back, but there are more colorful illustrations, hidden text, and hidden pictograms now. (Wasn’t this a movie?)

- You’ll see the effect of “raised printing.”

- The paper has a 3D blue ribbon woven into it. When tilted, you’ll see 100s moving side-to-side or up-and-down.

- Also, when the bill is tilted, a camouflaged bell will be seen within the copper inkwell.

And remember, I am starting a collection of these bills, so, if you receive any, please just send them to me.

Are You A Caregiver?

If you are caring for a relative in another state, you may be considered a resident of that state. New York State says you are. The days spent in the state caring for a sick relative counted toward the number of days in-state.

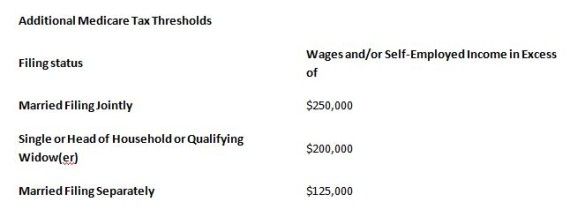

The Additional .9 Percent Medical Tax

As part of ObamaCare, this is a new tax for 2013, which is levied on wages and self-employment income as follows:

As this is an excess Medicare tax, it is based on your Medicare wages, meaning that your 401(k) does not shield you. In addition, your employer does not match your extra tax. Medicare wages are reduced by pre-tax items, such as the flexible spending accounts for dependent care and medical.

Married? You add your incomes together, and unless each of you is earning no more than $125,000, there is no savings by filing separately.

Start a home business and have a loss to offset W-2 earnings? Sorry, they don’t offset each other.

Social Security Update

The wage base for 2014 increases from $113,700 to $117,000. (Source: SSA Fact Sheet [PDF])

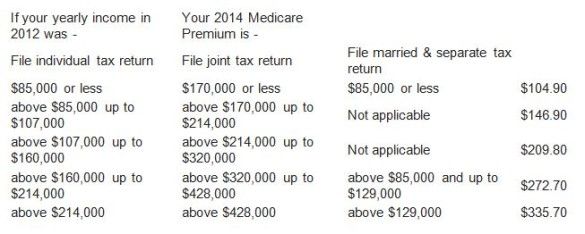

Medicare Part B remains the same at $104.90 per month, as does the deductible at $147. See below.

IRS Wrong In 51 Percent Of Correspondence Audits

The Treasury Inspector General for Tax Administration found that the IRS made errors in 51 percent of correspondence audits. I don’t know what the cost of this study was, but most tax practitioners could verify this if they were just called.

FSA Rule Change

Does your company offer you a FSA plan? Under this plan, you know that you have to use the money either by December 31, or if the company plan allows, by March 15 or the following year.

If your company plan makes you use the money by December 31 or lose it, here’s some good news. On October 31, the Treasury Department announced that employers can now offer you the option of rolling over up to $500 that you have left in your FSA account as of December 31. (Source). You can still contribute the max the following year. Most probably, this won’t affect you until next year, as companies need time to adjust programs.

The company plan can only offer one choice — use by December 31, or use by March 15. The plan cannot offer both.

Deduction For Long-Distance Commuting Expenses Denied

The Tax Court upheld the IRS in disallowing deductions claimed for commuting to a long-term job site. Only expenses for commuting to a temporary job site are tax-deductible. (Cor, TC Memo. 2013-240.)

Joseph Reisman, of Joseph S. Reisman & Associates, has been serving tax prep and business accounting expertise from his Coney Island Avenue office for more than 25 years. Check out the firm’s website.