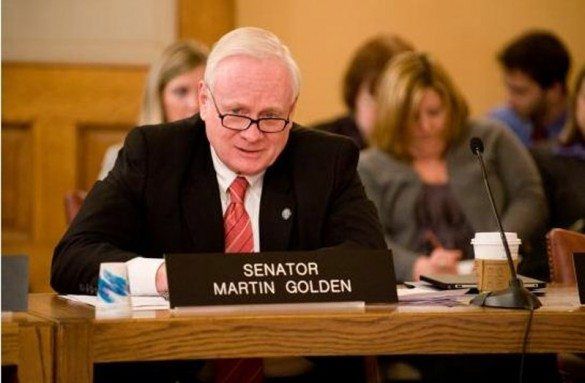

Subpoenas Sent To Real Estate Developers Who Were Given Tax Breaks By Golden & Co.

Subpoenas were issued to huge real estate firms that scored a windfall in tax breaks in legislation crafted by Republican State Senator Marty Golden and signed by Democratic Governor Andrew Cuomo. The Wall Street Journal is reporting that the Moreland Commission, a group set up by Cuomo to investigate public corruption, is looking into how developers of ultra-rich hotel-condo towers gained the valuable breaks.

Previously, we reported on the dubious legislation sponsored by Golden, which allowed huge tax breaks for five Manhattan properties. The legislation is expected to save developers like Extell Development, Silverstein Properties and Thor Equities tens of millions of dollars. The bill, which enjoyed bipartisan support and was signed into law by Cuomo, tacked on the expensive properties to the city’s 421-A program, a measure designed to spur residential building construction in less-dense areas of the city and subsidize affordable housing. Projects like One57, which is a 1,004-foot luxury tower featuring penthouses on sale for more than $90 million, were initially excluded from the program until Golden and other state politicians voted to include four developments as an exception under the umbrella of 421-A benefits.

Extell Development, which is building One57, has contributed hundreds of thousands of dollars to the campaign chests of both Democrats and Republicans, spurring the Moreland Commission to look into the affair. The independent Moreland Commission was set up by Cuomo after state legislators failed to pass comprehensive anti-corruption measures this year.

The Wall Street Journal described how the impending investigation might bring to light the uncomfortably close relationship between state politicians and major real estate developers:

One person who examined a subpoena from the commission, known as the Moreland Commission to Investigate Public Corruption, said the information requested was extensive, seeking emails and other communications with lobbyists and elected officials over multiple years relating to the tax break.

Kathleen Rice, Nassau County District Attorney and co-chairwoman of the commission, said the commission has begun issuing subpoenas, but she declined to say who received them or the topic of the inquiries. “We have not prejudged anyone or anything—we are going to follow whatever evidence we have, wherever it goes,” she said.

A spokesman for Extell said the company “will cooperate fully with any agency trying to improve government.”

The subpoenas could eventually help shed light on advocacy and lobbying by the real-estate and development sector, long a powerful force in Albany politics. Top landlords and their advocacy groups traditionally are prolific donors, contributing millions of dollars each election cycle collectively to the campaign committees of governors and influential members of the Legislature, and the outcomes of policies like taxes and rent regulation can cost—or make—them fortunes.

Golden and Assemblyman Keith Wright, the Democrat who sponsored the bill in the Assembly, may also be questioned during the investigation. When initially questioned by the press as to why the five properties were included under the umbrella of the 421a benefits, Golden and Wright both pleaded ignorance.

“These projects were ready to go,” Golden told the Daily News. “I’m not sure where they came from,” Golden said in response to who earmarked the developments for special favor.

“These five properties — it was important that they benefit from the piece of legislation probably, and I don’t know why, because some of the folks in the Senate wanted them to be included,” Wright told the Daily News.