New Loans Available for Small Businesses in Lander, Carroll’s Districts Only

Councilmember Brad Lander, Assemblymember Robert Carroll, the Hebrew Free Loan Society, and The Change Reaction have joined forces to provide a new option for interest-free loans to small businesses.

Hoping to remedy some of the gaps in federal loan programs, the Greg Perlman and Michael Clark Small Business Angel Fund will offer two types of loans. First, a 0% interest loan for up to $25,000 for businesses that are still operating and need support, and second, loans of $3,000-$7,500 for independent contractors and small business owners who have been required to close or cease operating during the crisis. The PPP loans operate on a 1% interest.

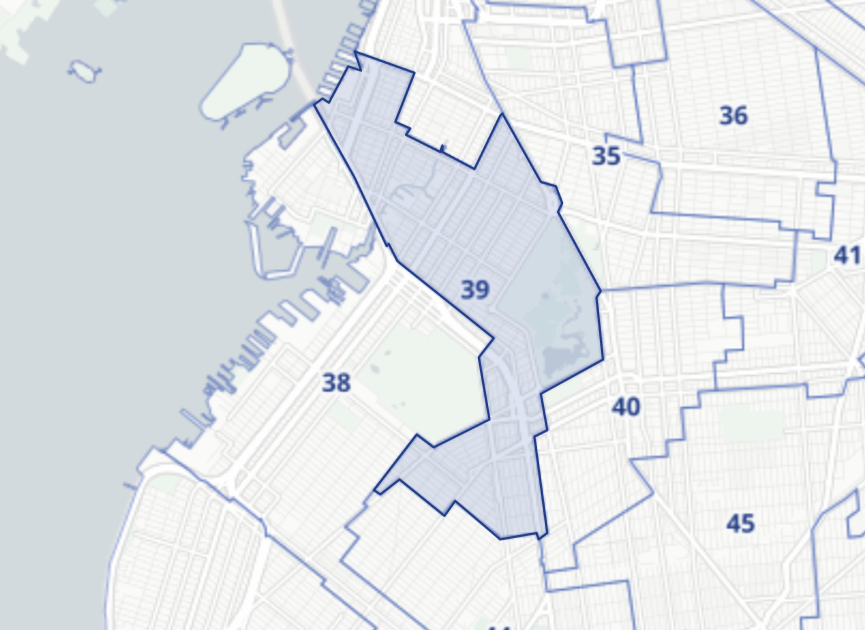

Both Lander and Carroll have spoken extensively about the hardships facing their districts, the 39th City Council and the 44th Assembly. Businesses in these districts will be the only eligible to apply.

“In conversations with small business owners in my district, I’ve heard over and over how difficult it is to get and then use the federal relief programs for small businesses,” Lander said in a release.

As a member of the Jewish community, Lander says he has long admired the work done by the Hebrew Free Loan Society, and was eager to work with them. As of now, there is no cap to the number of loans that will be given, he says, and that those who are eligible will be approved. In the first 24 hours of release, ten businesses had already applied.

The new loans will be repayable over 24-36 months, after an initial three month grace period. Businesses must have 15 or fewer employees, and normal revenues of $1 million or less to be eligible for application, as well as on-time rent payments for the 12 months leading up to and including March of this year. Applicants should hear back within five days of applying, which can be done here.

“This is really for quite small businesses,” Lander said. “The smaller businesses have an even harder time getting the federal programs. They’re less likely to bank with big banks, or have a treasurer, so this helps the really small businesses [that are] more likely to have trouble getting the PPP.”