New Flood Zone Lines Are Here

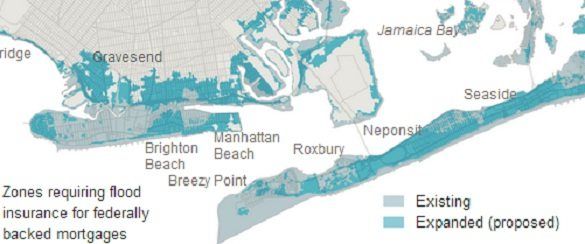

Earlier in the month, we reported that FEMA was planning to redraw and expand the flood zone lines for New York City for the first time since 1983. The redrawn flood zones, which carry heavy financial consequences for homeowners living in those regions, are officially here, according to a report in the New York Times.

FEMA was redrawing the maps right before Superstorm Sandy struck. The new lines place more 35,000 homes in flood zones, creating an unavoidable rise in insurance rates while also forcing the city to adapt the building code to account for potential floods. The Times explained in greater detail what the redrawn flood zone lines means for the city:

The maps will not formally go into effect for about two years, but the mayor’s office was already preparing an executive order to help owners of damaged homes rebuild to higher standards. That means that a badly damaged home that was not in the old flood zone, but is in the new one, would be allowed to rebuild to prepare for dangers predicted in the new maps. For instance, a home could be hoisted onto posts or pilings, which might have previously been disallowed because of zoning. “We’re working on an order that will enable people to rebuild, but rebuild in a way that’s safer,” said Caswell F. Holloway, the city’s deputy mayor for operations.

The expenses will undoubtedly be high for people forced to meet the new building regulations. According to the New York Times, a $250,000 home with a ground floor four feet below sea level, will have to pay a staggering $9,500 a year in flood insurance. By comparison, a home hoisted three feet above the flood line will only have to pay $427 a year.

FEMA is looking to help offset costs by providing $30,000 to homeowners to meet the new regulations when rebuilding. Whether that will be enough to raise a house on stilts is another question entirely.

“This is going to be very rough on people,” Chuck Reichenthal, district manager for Brooklyn’s Community Board 13, told the Times. “Insurance is going to zoom through the roof.”