More Of What’s New In Taxes

Telling Tips is a series of articles from local experts to help you save money, make better decisions and plan for a better future.

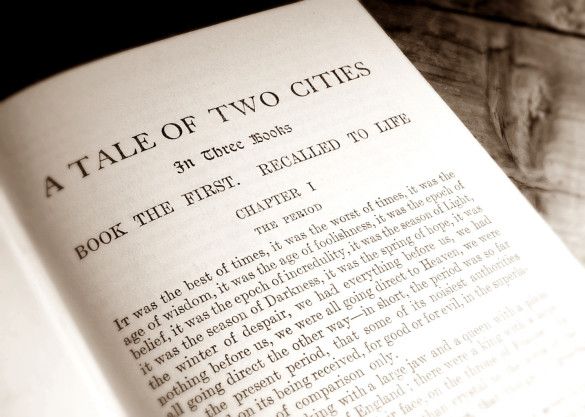

Can 2013 be described as in “A Tale of Two Cities” by Charles Dickens? “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair…”

Let’s make 2014 a better year by (1) filing a week earlier than you did last year, and (2) by calling me right after April to start the important financial planning that’s been on the back burner for so long.

Are You Ready? Set. Wait! The IRS has announced they will not begin accepting 2013 returns until January 31, 2014.

2014 Standard Mileage Rates

- 56 cents per mile for business miles driven

- 23.5 cents per mile driven for medical or moving purposes

- 14 cents per mile driven in service of charitable organizations

The 2013 Form 1040

It’s the same as the 2012 form — line for line — except that, on Line 60, “wealthy” taxpayers are directed to forms 8959 and 8960 to calculate their extra ObamaCare tax.

Trouble Reaching The IRS?

Click 1 to be on hold for an hour. Then click 2 to be disconnected. More of your questions will be directed through the new automated self-service options as the IRS looks to save money and manpower. There will also be a number of videos on irs.gov and YouTube. Good luck.

Points On Refinancing

When you purchase your personal residence, you can deduct the points in that year (if you want), but if you refinance, the points must be written-off (amortized) over the life of the mortgage. If you then refinance again with the same lender, the remaining balance of the amortized points need to be written-off over the life of the new loan.

Moving Out Of New York State?

If you are going to claim that you are no longer a resident, you must cut all ties, including changing your driver’s license, mailing address, voter registration, employment, doctors, place of worship, clubs, and your cemetery plot. (Call to discuss.)

Income Tax Withholding From Your Social Security Check

Online: Fill out the form (see here: http://www.irs.gov/pub/irs-pdf/fw4v.pdf), sign and date, and mail to your local Social Security office.

Medicare Part B And D Premiums For 2014

The 2014 Medicare Part B premium remains at $104.90 a month, unless your income in 2012 was above $85,000 for single filers or $170,000 for married filers. That increase will be the same as for 2013. Medicare Part D will rise slightly. The maximum for Part B and Part D will be $405 a month.

The IRS Is Watching

Expect an audit if you have tens of millions of assets or income, and use complicated financial and estate plans. Yes, the IRS Global High Wealth Industry Group will be after you.

The ObamaCare Penalty

Although the president signed his bill with 22 different pens, there are only a handful of exceptions (not covered here) to the penalty for not having coverage. The minimum penalty for 2014 (payable in 2015) is $95 per adult person in the household ($47.50 for children under 18), total penalty capped at $285; or one percent of your Adjusted Gross Income, with a cap of no more than the cost of the basic bronze-level policy on the exchanges. Got it? (Why didn’t our representatives read this law before passing it?)

Loophole? The penalty for not having insurance is not a penalty, but a tax, which the IRS is authorized to collect. How? By taking it out of your refund! If you don’t have a refund, the IRS cannot put a lien on your property or put a levy on your income to collect. Further, there is no interest charged. Therefore, if you don’t have (or want) coverage, don’t have a refund. Note: An overpayment in a future year will be applied to earlier year tax-penalties.

Distribution From College Savings Plan 529

This area is the next IRS target. The money must be used for college expenses, but there are a number of minefields. For example, if the tuition is $4,000, and you claim the American Opportunity Credit, the tax savings is 100 percent of the first $2,000, plus 25 percent of the next $2,000. This means that you cannot use $4,000 of 529 funds to pay for the tuition, as that would be double-dipping. Also keep in mind that the distribution must be in the year that the tuition is paid, not when the student graduates. In addition, the 529 funds cannot be used to pay off the college loan.

Municipal Bond Interest

Your may have an investment in a muni-bond fund. Keep in mind that although the interest is fully tax-free on the federal side (generally), only the interest for your resident state is tax-free on the state side. Make sure your year-end statement itemizes the interest income from each state.

QUIP: I started out with nothing, and, thanks to Uncle Sam, I still have most of it.

Joseph Reisman, of Joseph S. Reisman & Associates, has been serving tax prep and business accounting expertise from his Coney Island Avenue office for more than 25 years. Check out the firm’s website.