Heaping Servings Of Halloween Humor With Tax Tips On The Side

Telling Tips is a series of articles from local experts to help you save money, make better decisions and plan for a better future.

Boooooooooo!

The year is almost over. I hope you’re having a good year. First, the bad news: The price of chocolate is going up. Yep, over the past 12 months, cocoa butter prices have risen 70 percent.

Now, the good news: There’s still time for year-end tax planning. Don’t be scared — planning will not hurt you.

Do you have your costume?

Jean Claude Van Damme, Steven Seagal, and Arnold Schwarzenegger decide to go out trick-or-treating together for Halloween as historic musical composers. They go to a costume store.

Jean Claude sees a costume he likes. “I think I’ll go as Beethoven,” he announces.

Steven sees one that grabs his attention. “I’ll be Mozart.”

Arnold was having a tough time finding a costume, but finally he discovered one that appealed to him, and says, in a heavy Austrian accent: “I’ll be Bach!”

Happy Halloween!

What Are Your 401(K) Options When Changing Jobs?

If you are younger than 59 and-a-half years of age, how you roll over your 401(k) is an important decision. When changing a job, in which you have a 401(k) plan, you can leave the money with your former employer’s plan, or roll it over to a new 401(k) or into an IRA. Leaving the funds in your former plan leaves your money restricted, with possibly expensive investment choices, as well as various restrictions that the company administrator imposes.

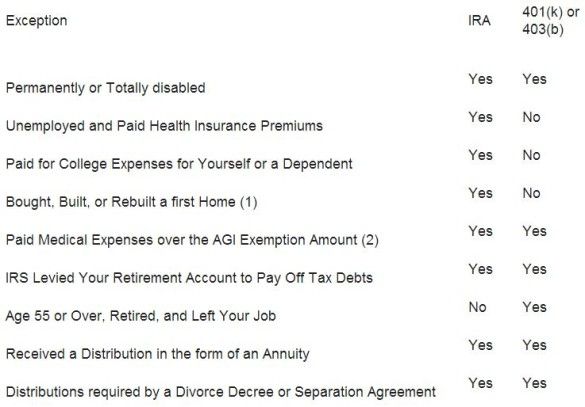

Rolling the money over into an IRA gives you the ability to invest as you choose, lower administrative costs, and give you control. However, you can’t withdraw these funds without the 10 percent penalty on top of the regular income tax.

If your new employer’s plan allows it, you can add your funds to the new plan. One advantage of the 401(k) is that you can withdraw those funds (with conditions) without the 10 percent penalty if you are under 59 and-a-half. Additionally, if you terminate after 55 years old, you can withdraw the funds with the penalty. One downside is that if you remain here after 59 and-a-half, and the plan does not allow in-service distributions, you won’t have access to your money until age 65, instead of 59 and-a-half if you had not rolled over the money.

Here’s another suggestion: In today’s economic climate, you may want to start your own business. If so, you can create your own solo 401(k) and rollover the funds into your plan. If you need additional funding for your business, you can tap your plan if you are at least 55 years old. Don’t jump into this, because Big Brother is watching. This business must be valid, and generally, sustainable.

Note that if you leave your employment and are more than 55 years of age, your distribution from your 401(k) plan is not subject to the 10 percent early withdrawal penalty as is the IRA. (It is still subject to regular income tax.) However, I would suggest leaving the money in the old 401(k) until you are 59 and-a-half, just in case you need the fund, as you will have access to it, penalty-free. If you are a retiring cop, firefighter or medic, your distribution age is 50, not 55.

- The home-buying exception has the following additional criteria: You did not own a home in the previous two years, and only $10,000 of the retirement distribution qualifies to avoid the tax penalty.

- You do not need to itemize in order to claim the medical expense exception, but the withdrawal must be in the same year as bills incurred.

For more details, check out publication 590 at www.IRS.gov.

Question: What Are The Deadlines We Need To Watch?

Answer[s]:

- December 15, 2013: Date you need to be enrolled by for coverage to take effect on January 1, 2014;

- February 15, 2014: Date you must have coverage by in order to be exempt from the Individual Mandate Tax; and

- March 31, 2014: Final date to enroll for calendar year 2014.

Due to the problems in signing up at this time, I suggest you wait for about three weeks. Maybe by then the software will be better (but don’t hold your breath).

If you don’t have insurance, you will be subject to the penalty of $95 or one percent of your Adjusted Gross Income. For most of you, the penalty will exceed $95, but will still be much less than the cost of insurance.

Update: The White House has now said that “…if you sign up for insurance by the end of March, you will not face a penalty.”

Quip: Just as terrorists are no longer called terrorists, so any increase in taxes will now be called “revenue enhancement fees.”

Joseph Reisman, of Joseph S. Reisman & Associates, has been serving tax prep and business accounting expertise from his Coney Island Avenue office for more than 25 years. Check out the firm’s website.