Filing A Tax Return Extension – Know The Penalties

Tuesday Tips is a series of articles from local experts to help you save money, make better decisions and plan for a better future.

Considering filing an extension on your tax return? Do you know what the consequences of that are? Here are a few terms you may want to familiarize yourself with:

Failure to Pay Penalty

Underpayment Penalty

Underpayment Interest

Failure to File Penalty

Tax Fraud Penalty

Accuracy Related Penalty

Criminal Tax Penalty

Whoa. None of those things sound good, right? Let’s take a minute to learn the best way to file for an extension and avoid penalties.

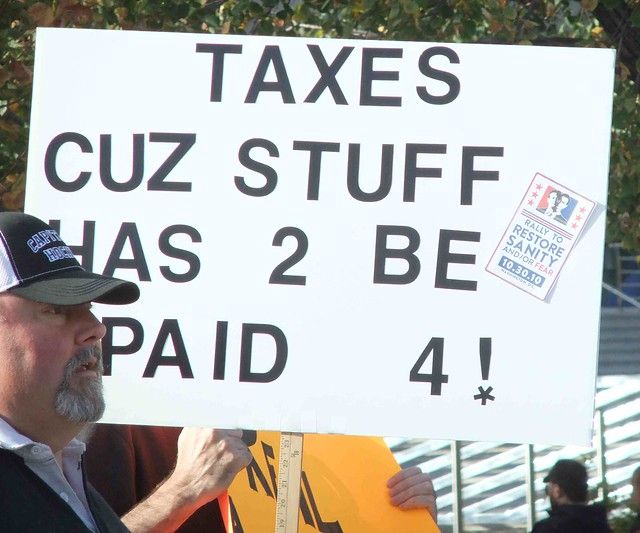

I hate to pay my income tax. There are so many other things that I could do with the money that would really benefit me (and the economy). But the ‘good old boys’ in Albany and Washington seem to have control of this portion of my life (my wife having the rest of it).

So I postpone my income tax filing with an extension (Federal form 4868). This allows me six more months, from April 18 to October 15, to complete the paperwork, but it is not an extension for paying the taxes. If I don’t pay what’s due, here are the additional charges:

- Interest: The IRS generally charges interest on any unpaid tax from the day the tax is due to the date it is paid. The current interest rate is 4 percent. (A lot less than credit card companies, though.)

- Plus a Failure to Pay Penalty: Even if I file an extension, if I owe more than 10 percent of my final tax liability, I can expect to get hit with a “failure to pay” penalty on the balance that runs at 0.5 percent per month.

- Plus a File Penalty: If I don’t file my extension request by April 18, this penalty is 5 percent a month, up to 25 percent of the taxes owed, which is in addition to the interest and failure to pay penalty.

So, as an example, if I have a federal tax liability of $20,000, I can’t owe more than $2,000 when I finally file.

Further, if I don’t file for that extension, I can be assessed a penalty of $100 a month on that $2,000.

And then I have to deal with my wife.

But, does an extension increase the chances of me being audited? My barber says absolutely it does. Actually, it does not. The IRS doesn’t generally choose audit targets until the final deadline in October. Extensions are so commonplace that you get the six extra months without even giving a reason!

So what to do if I owe more than I can pay?

First, pay something against your balance. This cuts down on the late payment penalties and interest charges as these are assessed on the unpaid tax from the day the tax is due until it is paid.

Call the IRS at (800) 829-1040. If you only need a few months to pay off the balance, it will probably be granted with just this phone call. If a longer time is needed, a payment plan can be set up.

One insider point on the penalties: If you have a reasonable cause, the law lets the IRS remove or reduce penalties. Just call the IRS and explain your situation (I guess this is what Charlie Rangel did to have his penalties dramatically reduced).

The final suggestion is simple. Since the failure to pay penalty is so much smaller than the failure to file penalty, always try to file your tax return, or extension, on time, even if you can’t pay the full amount.

Joseph Reisman, of Joseph S. Reisman & Associates, has been serving tax prep and business accounting expertise from his Coney Island Avenue office for more than 25 years. Check out the firm’s website.