City Releases Tax Lien Map Showing Hundreds Of Local Homes Might Be Sold

Over 500 single family and small residential buildings in our area are on the City’s tax lien sale list — this year’s sale is coming up soon, May 12th.

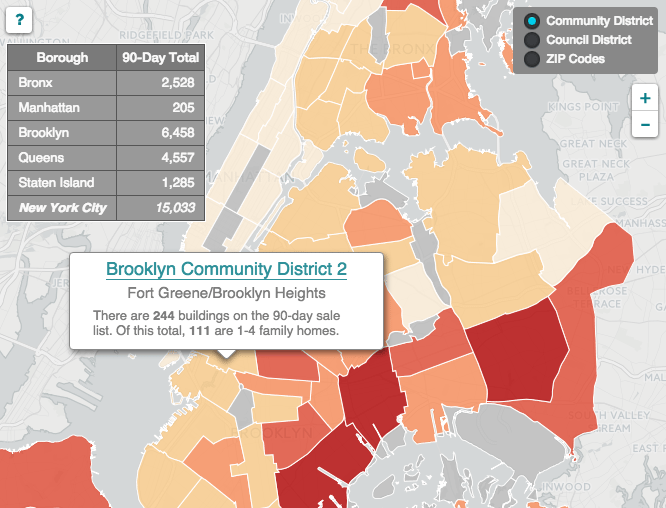

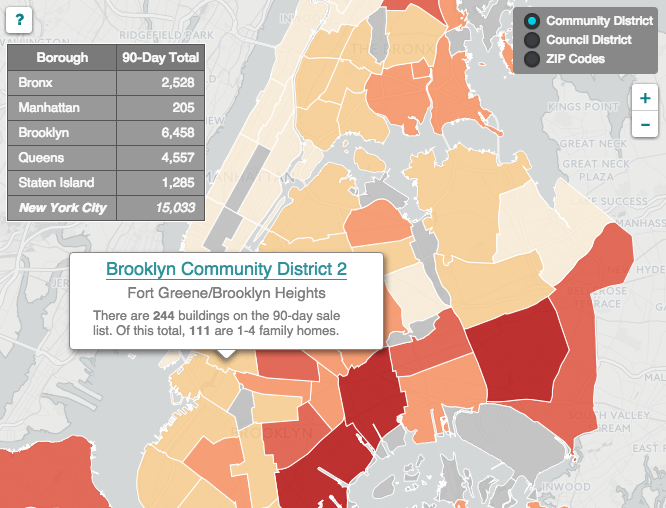

The Center for New York City Neighborhoods (CNYCN) reported last week that 6,458 buildings in Brooklyn have been targeted by the City for unpaid taxes and water bills, and almost seventy percent of them (1,338) are 1 to 4 family homes, condos and co-ops.

The City’s Department of Finance sells tax liens [the legal right to a property until a debt on that property has been discharged] on buildings if owners have not responded to at least four notices or entered into some sort of a payment plan.

The liens are sold to third-party collection agencies, who “can add fees and high interest of up to 18 percent, compounded daily,” the CNYCN said. And this can place a homeowner at greater risk of foreclosure because of “mounting debt.”

Just over 15,000 1 to 4 family buildings are on the sale list across the five boroughs, the CNYCN reported. Almost half of those buildings — 43 percent — are in Brooklyn.

The group notes that households can still get off the City’s tax lien sale list by entering into a payment agreement or securing some sort of an exemption.

Read here for more information from the City, and here for more information from the Center for New York City Neighborhoods.

Buildings Currently On City’s 90-Day Sale List

Council District 35 (Laurie Cumbo):

521 buildings on the list; 308 of them are 1-4 family buildings

Community Board 2 (Fort Greene, Clinton Hill, Brooklyn Heights, Downtown Brooklyn):

244 buildings on the list; 111 of them are 1-4 family buildings