Caught Between Rising Waters and Rising Rates In Brighton Beach

BRIGHTON BEACH – Earlier this year, Hurricanes Florence and Michael cut huge swaths of destruction across the southeastern United States, hundreds of miles from Brooklyn. In Brighton Beach, a neighborhood devastated by Hurricane Sandy in 2012, Hassan Ahmad, is keeping a wary eye on the weather.

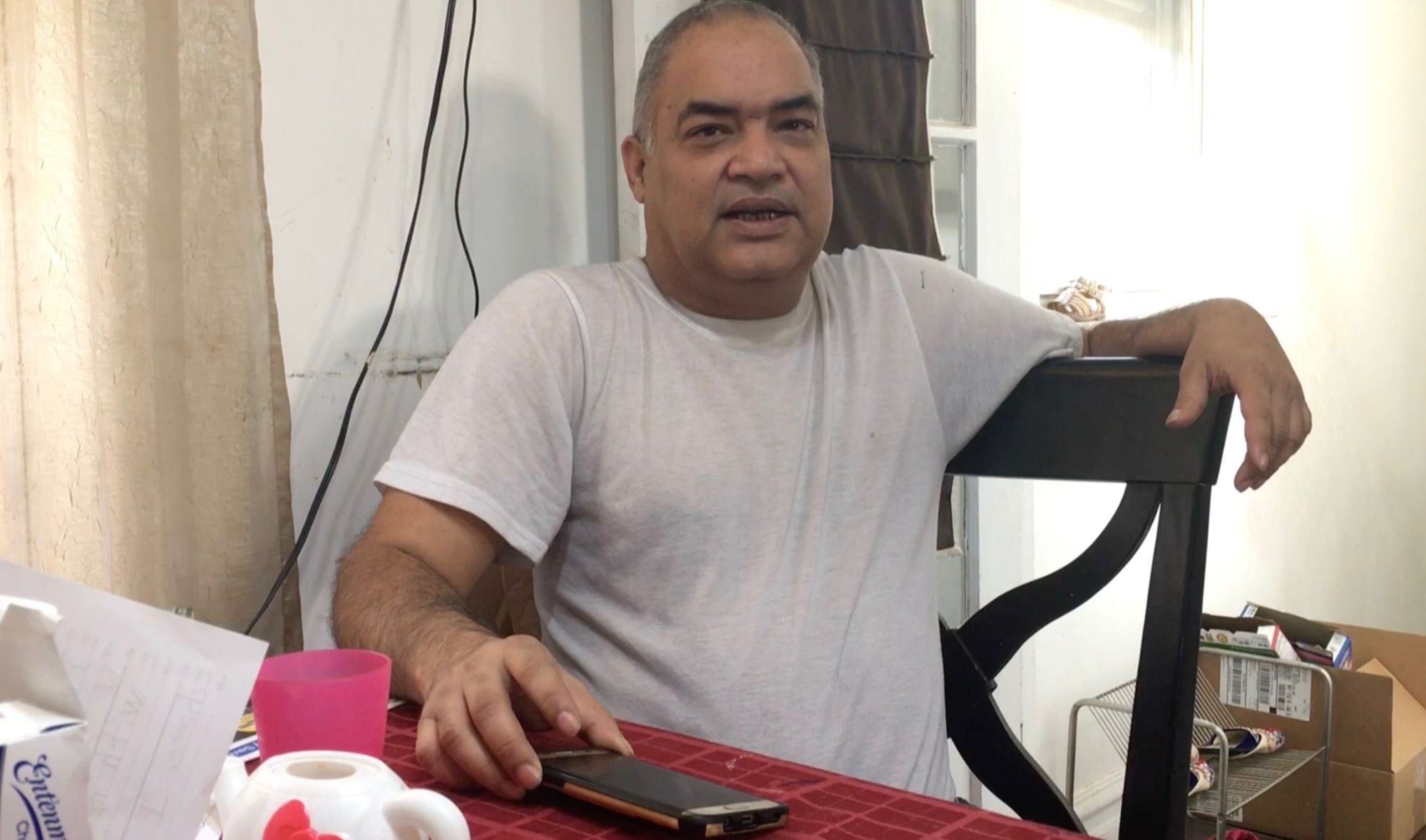

“It’s always in the back of our heads,” said Mr. Ahmad 45, an aircraft engineer who lives with his wife, three young children and an elderly mother in a two-story house just a few blocks from the end of Sheepshead Bay. “Eventually, something’s going to come.”

The Ahmads’ home on Brighton Seventh Street suffered major damage during Sandy when floodwater came up to just below the second story windows. The Ahmads still live there and are currently paying off two mortgages on the house.

“We don’t have any other property,” said Mr. Ahmad, whose parents brought him to Brooklyn from Pakistan when he was seven years old. “We can’t afford anything else.”

Brighton Beach residents like the Ahmads say they can’t afford to leave, but the costs they would incur to rebuild when the next big storm strikes mean they also can’t afford to stay.

As Mr. Ahmad put it, “It’s the American Dream going down the pipes.”

Hard data on the number of families in the Ahmads’ situation is hard to come by. The census, for example, does not track the reasons why residents might leave any given area. There is evidence, however, that Hassan and his family are not alone.

Flood insurance is a major expense for homeowners in coastal Brooklyn. The median cost of flood insurance in areas at high risk of flooding—including the vast majority of Brighton Beach – is $3,000 dollars a year in New York City, according to a 2017 study by the Rand Corporation.

However, costs can vary wildly for houses within even a few hundred feet of each other. Insurance rates are determined by the topography of the land, not street address. Flood insurance can be hundreds or thousands of dollars more expensive depending on a house’s exact location.

Even though the costs of insurance are increasing, and the risks remain high, Brighton Beach is still the cheapest available option for many families like the Ahmads.

“Leaving is a difficult option because where can you afford to go?” said Elizabeth Malone, the program manager for insurance and resiliency at Neighborhood Housing services of Brooklyn, a non-profit that helps low-income families navigate the process of home ownership.

Many of the more affordable neighborhoods in or near New York City are also in coastal areas at risk of flooding, said Malone. The areas that are inland present other financial challenges such as the cost of transportation or higher property taxes.

Even if the Ahmads were able to sell their house, Malone stressed, “whether they would have the funds from selling to repurchase” a new home elsewhere “would be a very close call.”

“It’s not that they might not find a home, but it’s going to be very tough,” she said. Brighton Beach’s particular mix of flood risk and a large immigrant community make for a very specific set of challenges for residents, said Malone.

“You see a lot of older families who have been there generationally,” she said and many new immigrants who are also new homeowners. Those families tend to invest heavily in their homes, and then pass them along to their children. For many immigrant families, she said, “the home is your entire financial life.”

Mr. Ahmad, meanwhile, is mulling the possibility of taking his young family abroad, just as his parents brought him to the United States. “Norway or England or something like that,” he said. “I’m a technical person, I can get a job in a heartbeat.”

Someday soon, the weather may force his hand.