Activists And Lawmakers Call To Abolish City’s Tax Lien Sale

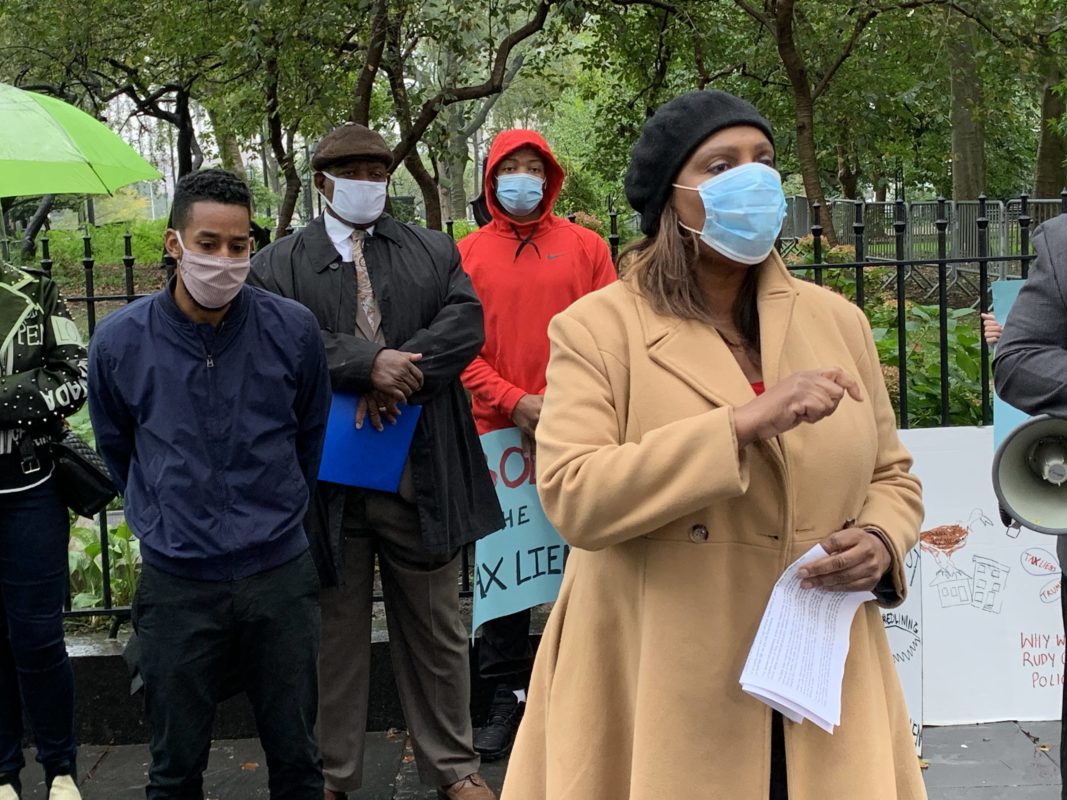

Activists, advocates, and elected officials stood in the wet cold outside City Hall Tuesday morning, October 13, calling to abolish New York City’s tax lien sale. The rain was appropriate, organizer Albert Scott said, “These are the tears of my community in reference to this tax lien sale.”

Every year the Department of Finance sells off municipal debts (liens) delinquent for a certain number of years. Those liens are unpaid property taxes, water and sewer bills, and other charges owed to the city. DOF evaluates a lien – which can be as low as $1,000 – for sale based on property and debt type.

If deemed eligible, DOF says it sends “at least four notices” to those responsible for the debt explaining the sale and their options to be removed from it. New Yorkers can pay their debt in full, set up a payment plan, or get an exemption. Unsettled liens are then bundled and sold by DOF to third-party debt collectors, who can charge fees and interest up to 18%, potentially resulting in foreclosures of said properties.

From 1997 to 2015, the sale brought in more than $1.3 billion in revenue, according to a report by NYU Furman Center, which studies urban housing and neighborhood issues. The city desperately needs the cash as it works to address a potential $9 billion revenue gap. Mayor de Blasio estimates this year’s sale could bring in $57 million, which he suggested could be used to pay for education and health expenses.

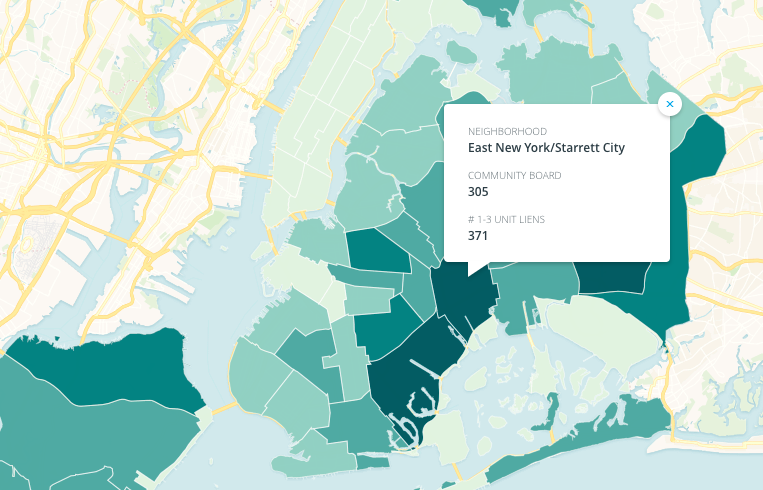

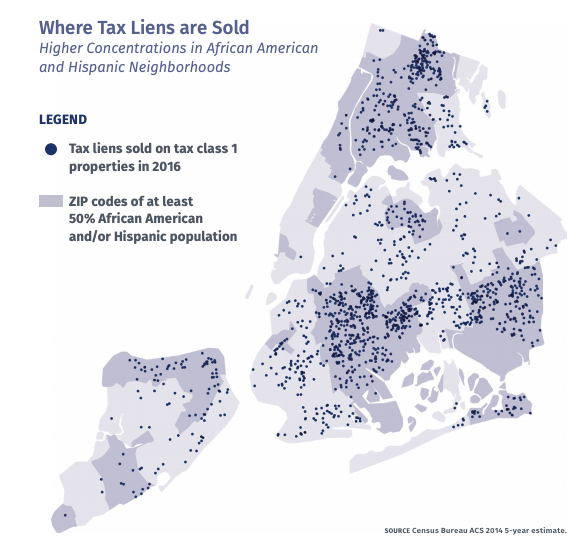

After several delays due to the pandemic, this year’s sale is currently set to commence Nov. 4 and includes more than 9,000 eligible liens across the city. Of those, properties in Brooklyn account for 3,890 or 42%, concentrated in Central and South-eastern parts of the borough that are home to mostly residents of color, according to data from NYC Planning Department.

“The lien sale has a destabilizing effect on communities of color,” said New York State Attorney General Letitia James, who has fought against the sale since her days as public advocate.

“What we are seeing in communities of color is the greatest transfer of wealth in recent memory.”

“When we talk about the fact that our city is balancing the budgets on the backs of Black and brown communities, I can see no other identification of this problem other than these tax sales,” said Assemblywoman Latrice Walker, who represents Brownsville and parts of East New York, areas heavily affected by the sale.

The city sells liens throughout the five boroughs, but the sale is especially disruptive — and concentrated — in neighborhoods of color. The Coalition for Affordable Homes analyzed the Furman report and found that between 2010 and 2015, just two community districts – Brooklyn CB5 (East New York) and Queens CB12 (Jamaica and Hollis) – accounted for 18% of the liens on one-to-three family homes sold by the city, excluding Staten Island. CB5’s population is approximately 52% Black and 38% Hispanic, while Queens CB12 is approximately 62% Black and 16% Hispanic, according to City Planning data.

Brother Paul Muhammad, a member of CB5, spoke at the event with his son, Chris, standing by.

“Let’s call this what it is. This is not gentrification. What’s been happening to our communities is ethnic cleansing through economics,” said Muhammad.

“Abolishing at this point seems like the only solution that we have to ensure that our Black and brown communities are not more affected during this crisis,” said Council Member Antonio Reynoso, who represents District 34 (Bushwick, Williamsburg) and is running for Brooklyn Borough President in the 2021 local elections.

The sale began under Mayor Giuliani in 1997 and was last renewed by the city council in 2017.

“It is really time to purge Rudy Giuliani’s bad idea from the city. And there seems like no time like the present,” said Paula Segal, senior staff attorney in TakeRoot Justice’s Equitable Neighborhoods Practice.

Unless reauthorized by the council, the lien sale will expire at the end of this year. Council Member Daniel Dromm, Finance Committee chair, did not immediately respond when asked whether he would introduce legislation to renew it beyond 2020.

“We’re here to put [the council] on notice that if you have the audacity to even think about reauthorizing this sale, you will have to explain to members throughout this city why this is taking place,” said Albert Scott, City Hall looming over his broad shoulders.

“How progressive are you, City Council, when it comes to abolishing this tax lien sale?”