New Study By Comptroller Stringer Shows Spike In Retail Vacancies

BROOKLYN – A new study by Comptroller Scott Stringer’s office shows that Brooklyn is facing a substantial spike in storefront retail vacancies and rents.

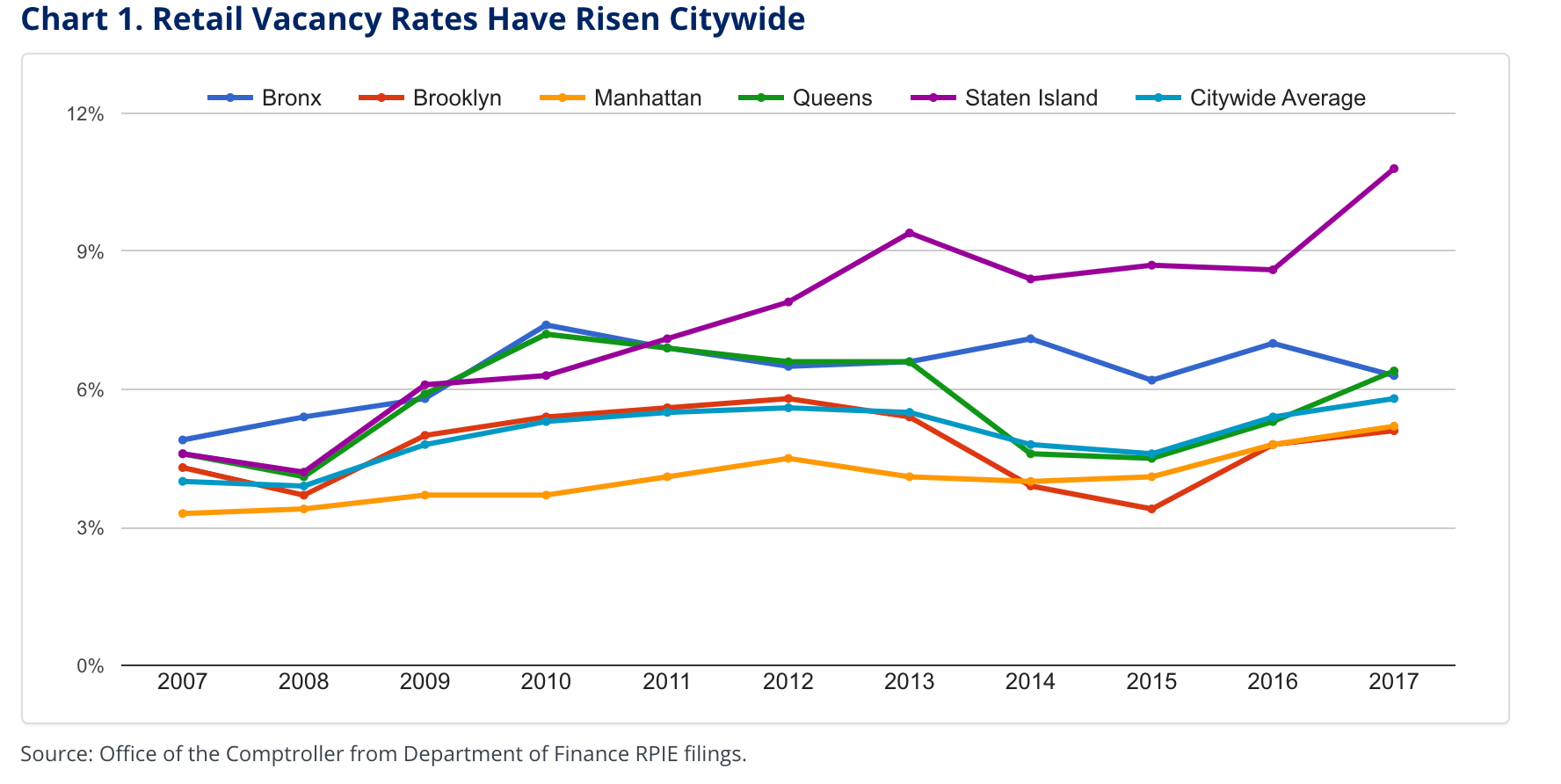

According to the study, the rate of empty and vacant storefronts across the five boroughs has increased by about 50% over the past decade, rising to a high of 5.8% in 2017. The study took into account the different neighborhoods and specified each by zip codes.

- For zip code 11216, which includes Bedford Stuyvesant and Crown Heights, the total retail space in 2017 was 1.5 million square feet. Now, there are 264 vacant retail spaces in that area.

- 11217, which includes Boerum Hill and areas around Barclays, total retail space in 2017 was 2.5 million square feet. The vacant retail spaces now are 182.

- 11221, which includes Bedford Stuyvesant and Bushwick, total retail area in 2017 was 1.7 million square feet. Now, there are 176 vacant retail spaces.

- 11224, which includes Coney Island, total retail area in 2017 was 1.3 million square feet. Now, there are 76 vacant spaces in the area.

- 11233, which includes Ocean Hill, total retail space in 2017 was 857k square feet. Now, there are 211 vacant spaces.

- And in 11249, which includes Williamsburg, the total retail space in 2017 was 1.7 million square feet. Now, there are 124 vacant retail spaces in the area.

Over the last decade, the amount of vacant retail space has increased by 5.2 million square feet in NYC. According to the study, between 2007 and 2017, the City’s “economy expanded rapidly as 350,000 new residents poured in and 660,000 new jobs were created. During that period, the amount of retail space in the city also expanded considerably, by about 27.1 million square feet.”

“However, as the City grew, so did the vacant retail space. Citywide, the retail vacancy rate rose from a low of 4.0% in 2007 to 5.8% in 2017,” the study noted.

Community leaders have already voiced concerns about the number of vacancies. In December, Council Member Justin Brannan penned an op-ed for the Brooklyn Reporter, saying, “Sometimes it feels like every other week, another store or restaurant that’s been around forever suddenly announces it is closing. And while businesses come and go, and good things don’t last forever, it’s clear the outgoing shops, stores, and restaurants aren’t being replaced by new ones as quickly as in the past.”

In fact, back in March, Bklyner looked at the vacant businesses in Bay Ridge and learned that finding the underlying cause of the problem is quite difficult. Stringer says it has to do with the expanding of NYC’s economy, online shopping, rising commercial rents, and “burdensome regulatory hurdles.”

“[It’s] partly due to the skyrocketing growth of internet shopping, particularly Amazon,” the study noted. “The number of merchandise retail outlets in New York City rose by 19% between 2007 and 2017, while the number of personal services establishments rose by nearly 50%, and bars and restaurants soared by 65%.”

The study also examined regulatory hurdles and found that they are associated with greater retail vacancy.

“The share of Department of Buildings alteration permits unapproved after 30 days is a significant driver of retail vacancy. A one percent increase in this metric is associated with a 3.28 percent increase in vacant retail square footage. Although this metric fell sharply between 2007 and 2017, it increased substantially in 2018, particularly outside Manhattan.”

“The average number of days it takes to get a liquor license is also a significant driver of retail vacancy. A one percent increase in this measure is associated with a 0.17% increase in retail vacancy. In 2018, liquor license approval times increased citywide from roughly 50 to nearly 75 days, an increase of about 50%.”

In August, we reported on the NYC Department of City Planning’s (DCP) release of “Assessing Storefront Vacancy in NYC” which examined retail trends and storefront vacancies across the city “in the context of shifting technology, economic forces, and consumer preferences.” DCP analyzed 10,000 storefronts across two dozen study areas using Live XYZ, a database that maps ground-floor use in NYC. DCP also conducted field visits to confirm the data. The three takeaways from that study included:

- The retail industry is changing rapidly across New York City and the country;

- Vacancy rates are volatile, vary from neighborhood to neighborhood and street to street, and cannot be explained by any single factor;

- Vacancy is concentrated in certain neighborhoods and is influenced by local and citywide market forces and spending patterns.

Stringer then offered some recommendations to reduce the vacancies. They include:

- Provide tax incentives for independent merchandise retailers in high-vacancy retail corridors.

- Create single-point-of-contact customer service for businesses occupying retail space.

- Incorporate retail demand into neighborhood planning.

“New Yorkers have all seen the signs of our changing economy in the last decade, as vacant storefronts have become all too common and neighborhood institutions have fallen by the wayside. Our report shows the phenomenon of retail vacancies from one end of the city to the other,” Stringer said. “Change is the one constant in New York City – and sometimes, change can be overwhelming. Even as our economy has grown, many mom-and-pop stores have been left behind, transforming spaces once owned by local small businesses into barren storefronts.”

“This isn’t just about empty buildings and neighborhood blight, it’s about the affordability crisis in our city. We need to use every tool in the box to tackle affordability, support small businesses and ensure New Yorkers are equipped to succeed in the new economic reality.”