Need Help To Answer Your Property Value Questions?

If you own a house in Brooklyn, you received this week a notice of your property’s value from the City. It likely went up. Likely, your property taxes did too.

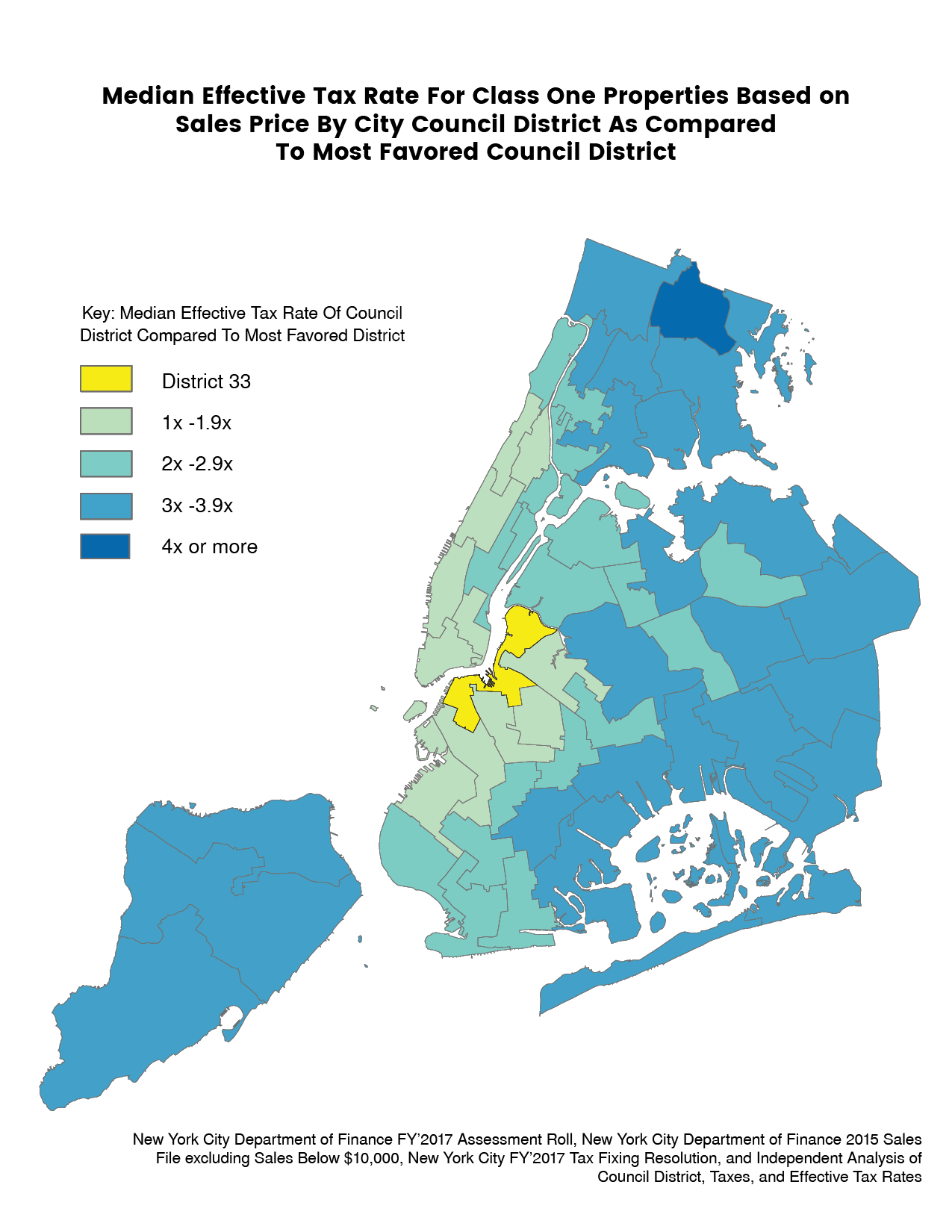

The value city assigns to your property forms the basis of tax calculations, which notoriously penalize those living in less affluent areas, over which there is currently a lawsuit.

For most 1-3 family homes the city calculates the value based on recent comparable sales, and then assesses 6%. This Assessed Value is not allowed to increase more than 6% a year of 20% over 5 years unless you have “made a physical change to your building”, thanks to a NY State law. Sometimes it means folks in Bensonhurst pay more in taxes than those in Park Slope for similar properties.

You are allowed to challenge the value the city assesses your house at, and NYC Department of Finance will hold two events in Brooklyn where you can talk to someone from the department about your particular case and how to dispute the assessment, as well as how to apply for exemptions (seniors, veterans, clergy, STAR, nonprofit etc).

Both events are going to be held at the Brooklyn Borough Hall (209 Joralemon Street), between 10 am – 12 noon on February 13, and between 6 pm – 8 pm on February 21.

If you disagree with the city over the value of your property, you have until March 15, 2018 to appeal to the New York City Tax Commission, and you can find all the details at their website at this link.

For the second year now, Senator Golden will also be opening his office to a volunteer, knowledgeable with how the process works, Sundays starting on February 18th. You do have to make an appointment, so please call ahead at 718-238-6044.