The Actual Odds Of Winning The Affordable Housing Lottery

With so many of the new developments that are required to offer affordable housing approaching completion, we’ve been posting about the opportunities to apply for the apartments one actually could try to afford to live in.

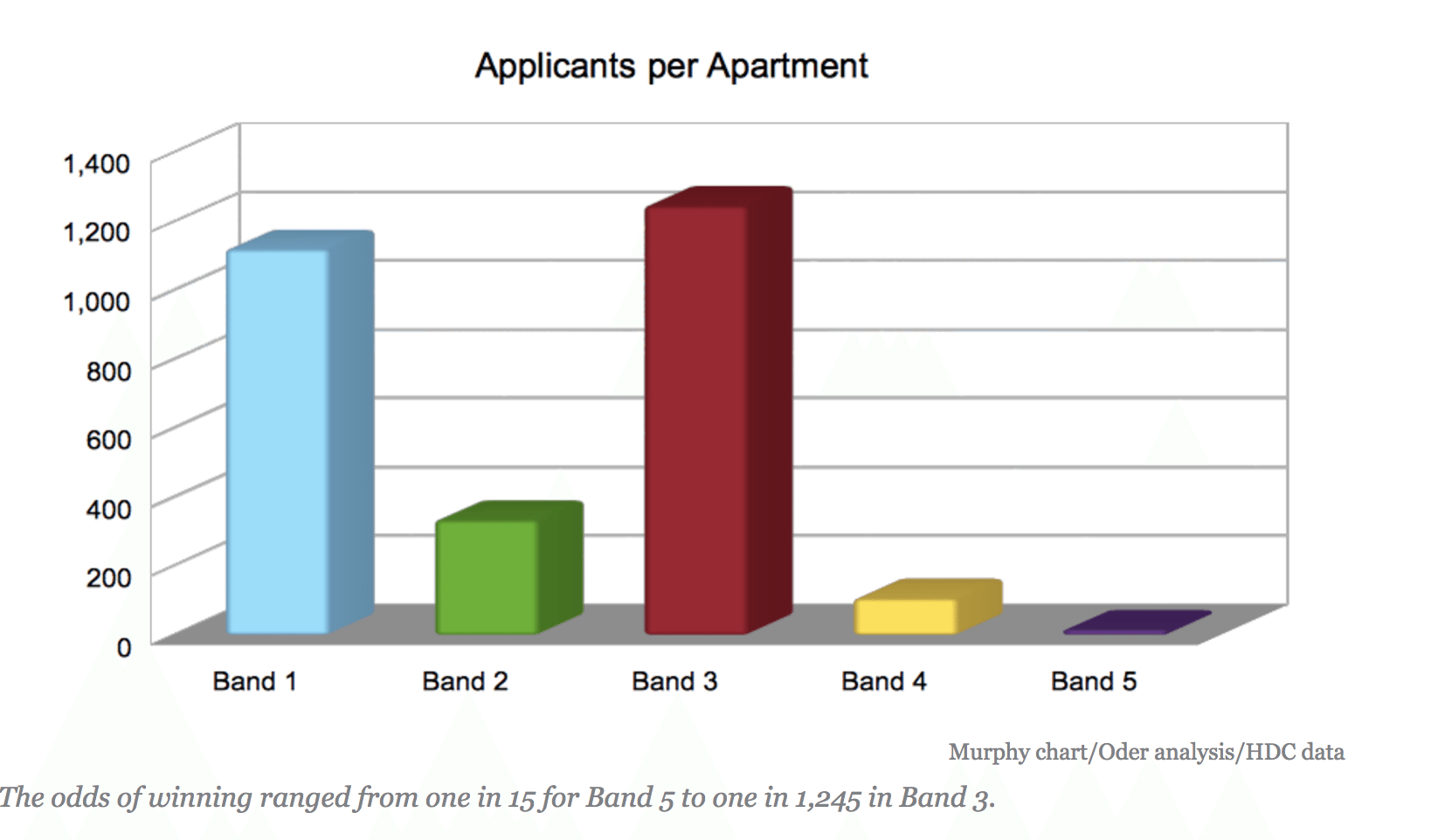

City Limits decided to look at the actual applicant pool for Pacific Park development (aka Atlantic yards) to see what they would learn. After filing a freedom on information request, they obtained the raw applicant data for the 92,743 households who entered the lottery for the “100 percent affordable” 535 Carlton from the city. Here are the odds for each income band, 5 being highest, and 1 being lowest income levels:

Your odds are best if you live in one of the community boards surrounding the Pacific Park development, as 50% of the units are to be allocated to residents of those areas and only 14% of the applicant pool were from those neighborhoods. They are even better, if you happen to also make a six figure salary and be in the market for one of the higher priced apartments:

Of the 92,743 households who entered the lottery “only 2,203, according to City Limits’ analysis, were eligible for 148 middle-income apartments, such as one-bedrooms renting for $2,680 monthly and two-bedrooms at $3,223, affordable to those earning six figures.”

Compare that to the odds of one in 1,245, if you were hoping to to score one of the truly affordable apartments:

“For less costly apartments, the competition was fierce. For the 15 moderate-income units, including seven one-bedrooms at $1,320, some 18,680 households applied.

More starkly, nearly 67,000 households, some 72 percent of the applicant pool, aimed at the 90 low-income units, including one-bedrooms at $589 and $929, for singles earning $21,566 to $25,400 and $33,223 to $38,100, respectively.”

This should not be surprising to anyone who lives here.

The median income in Brooklyn, according to census, is still only about $50,000 per household. Spending 1/3 of income, as is recommended, for rent would limit one’s options to apartments in the $1,375 range – without rent becoming too much of a burden. Unfortunately that is not the area median income that is used to calculate the affordable housing qualifications: “The AMI for 2016 is $90,600 for a family of four”, states NYC Housing Development Corporation, which includes Westchester in its calculations.

If you look at this report by Renthop that was published last week, what’s billed as affordable housing north of Prospect Park, would be for most part – more than market rates for the rest of us.

According to Douglas Elliman’s February market report, the entry level rental rates for new construction in Brooklyn were $3,284 month, whereas median rental rate for the entire borough was $2,750, which is also what the average rental rate is for a one bedroom apartment in Brooklyn these days, according to the report. This means that unless your household makes over $100,000, rent is a problem.

Market rate rentals at new construction in downtown Brooklyn, for example at The Ashland, are $3,500 for one bedroom, and over $5,000 for two bedrooms – under these conditions you can see how a one bedroom for $2,680 a month and two-bedrooms at $3,223 would be considered affordable housing.

But not for most of us.

It seems there are two ways to go about this – more market rate construction that is targeted at, interesting and affordable to the better off set of Brooklyn residents – the 25% of households that make over $100k, so they do not push the rest of us out of the further reaches of Brooklyn, or higher wages for the other 75%.