PPP And Additional Funding Dominate Small Business Town Hall In Southern Brooklyn

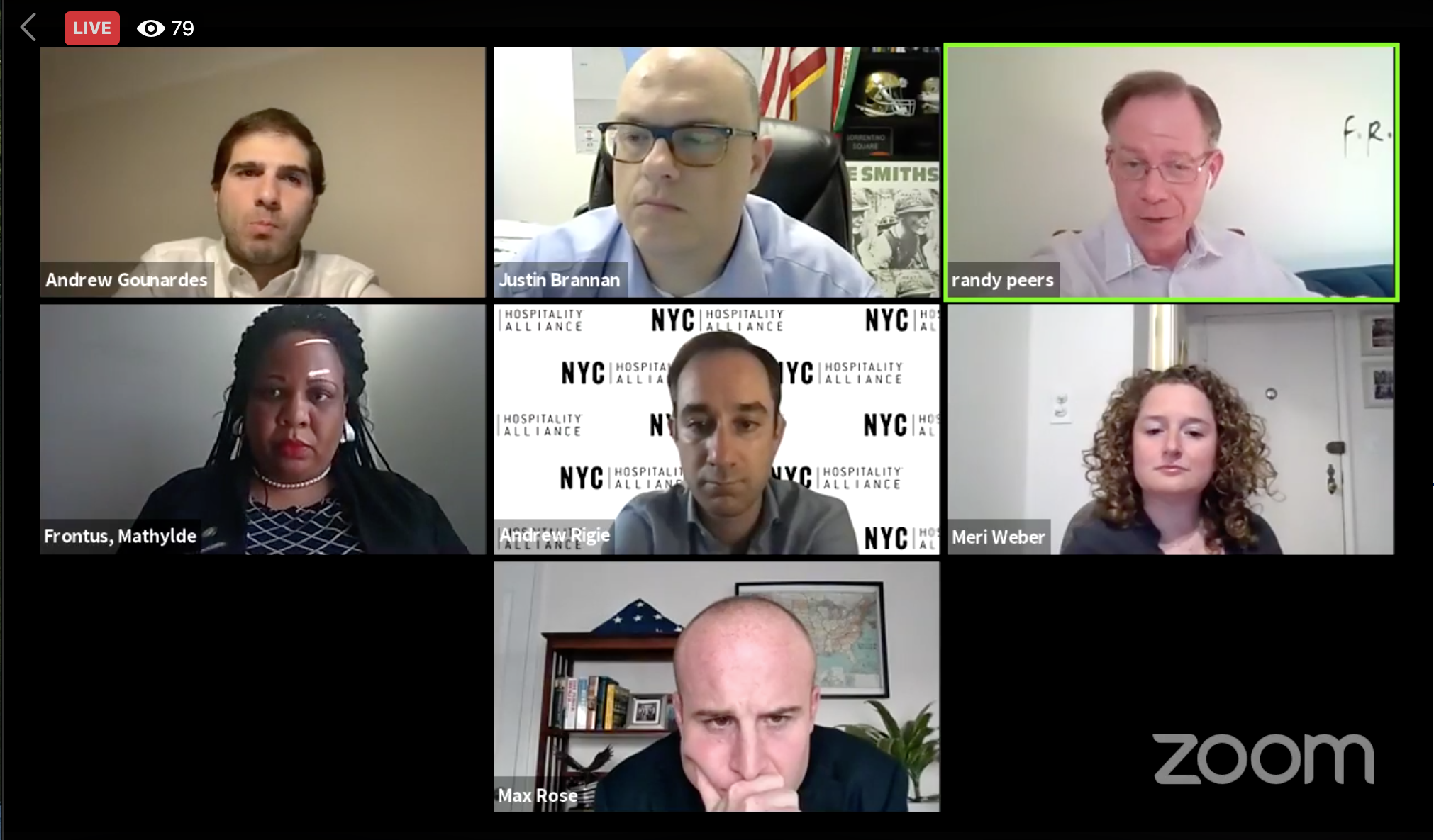

Southern Brooklyn’s elected officials logged onto Facebook Live Wednesday night to help local business owners struggling to stay afloat during the pandemic.

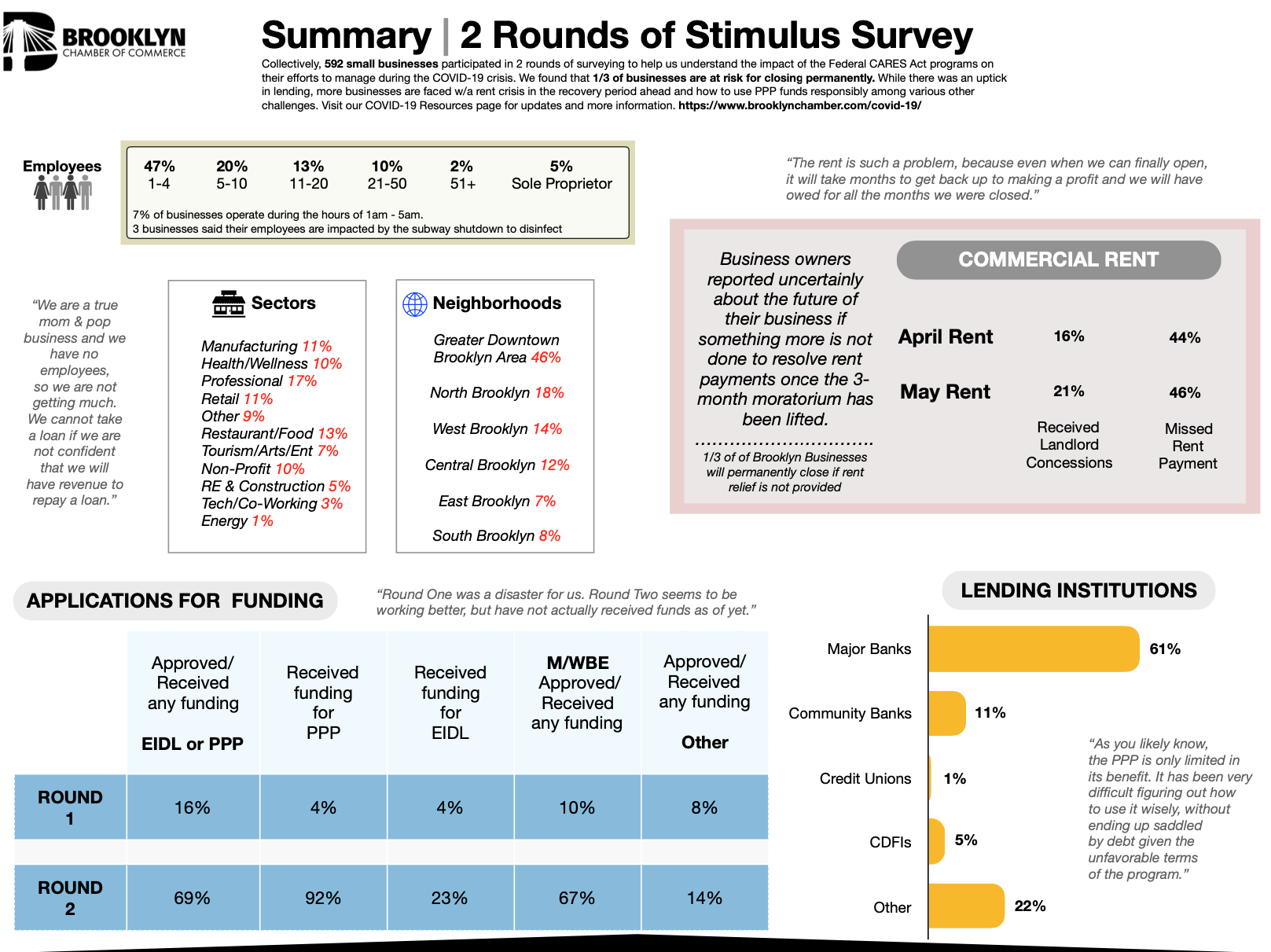

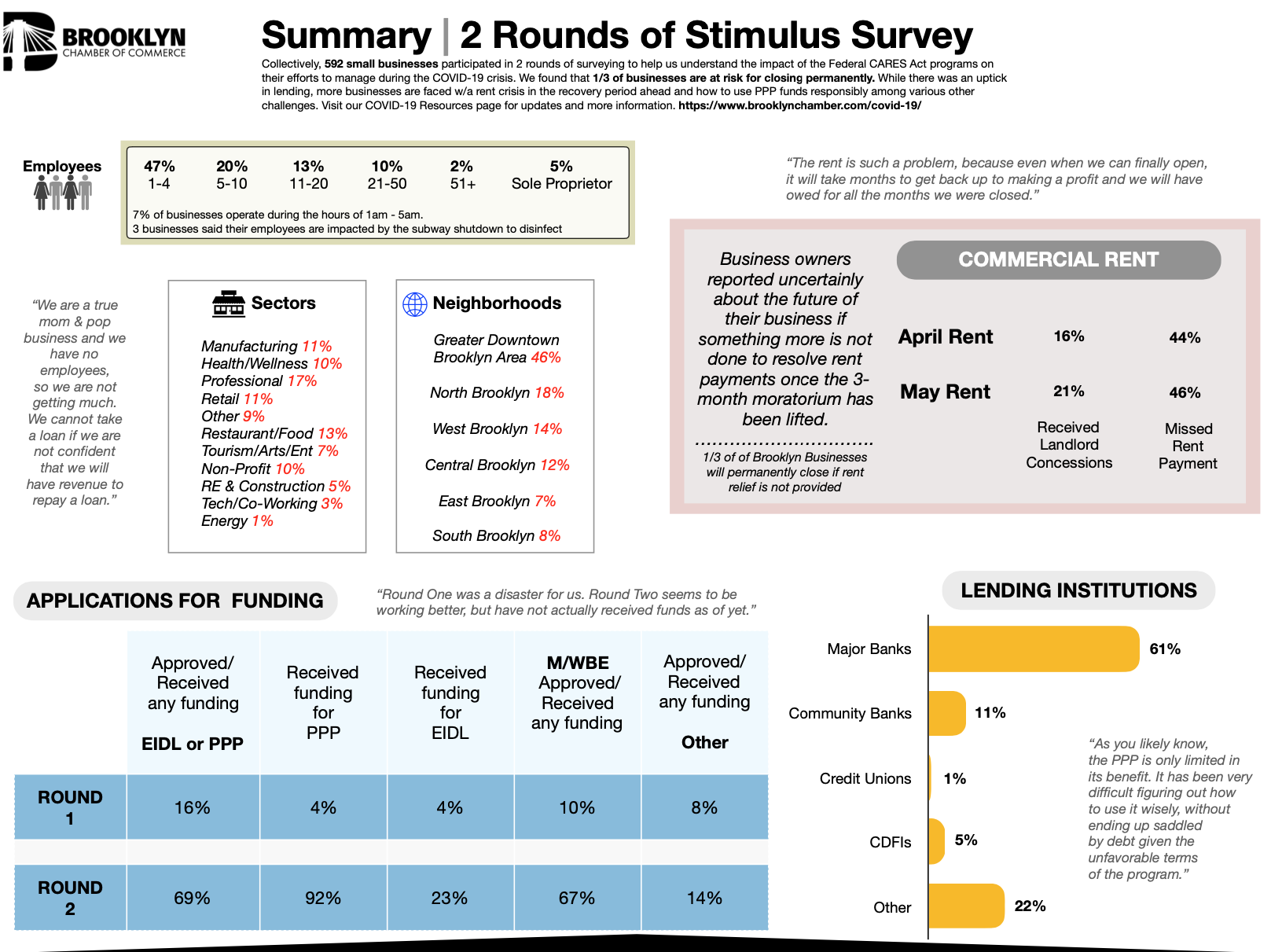

The Brooklyn Chamber of Commerce reported that one-third of Brooklyn businesses are at risk of closing permanently despite two rounds of federal lending opportunities. While roughly 92% of the 600 Brooklyn businesses they surveyed have received the Paycheck Protection Program (PPP) loan in the second round, that’s still not enough for business owners and their public officials to be satisfied.

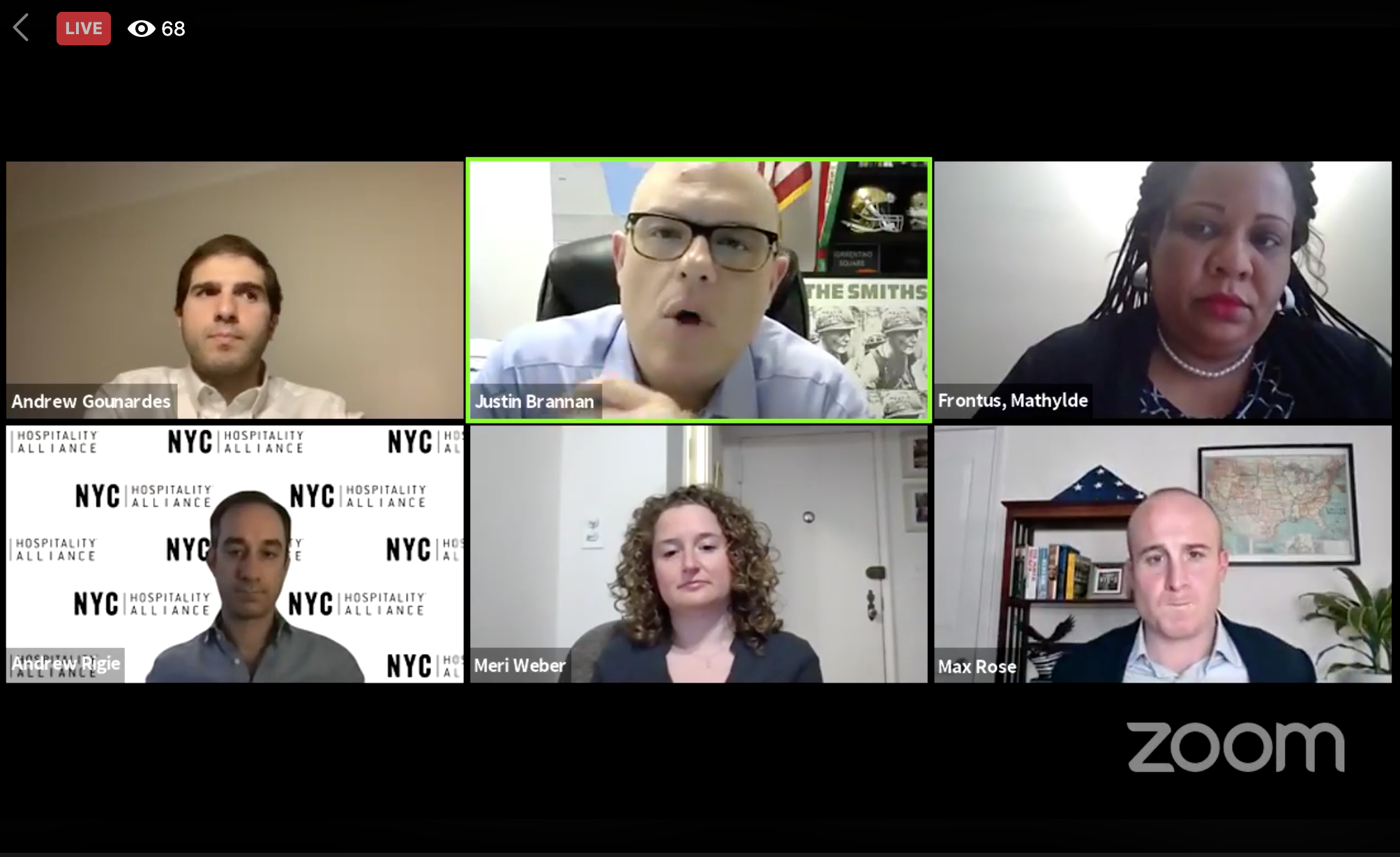

“A year from now, when the dust is settled, I want my neighborhoods to be the neighborhoods that they were–not completely unrecognizable,” said City Councilman Justin Brannan.

Alongside Brannan was Congressman Max Rose, Assemblywoman Mathylde Frontus, State Senator Andrew Goundardes, President and CEO of the Brooklyn Chamber of Commerce Randy Peers, Andrew Rigie of the NYC Hospitality Alliance, and Meri Weber of the NYC Small Business Services (SBS).

Those present unanimously agreed that the available lending for small businesses was not enough.

“We can’t be subtle, because when it comes to pandemic, look, you can’t do just enough,” said Rose, who called in from Staten Island.

Rose and Brannan are very familiar with the complexities of small business. Rose’s family owns the popular Williamsburg-based diner, Kelloggs, and Brannan has a slew of family and friends who are small business owners.

“It’s an industry that I care very, very much about, you know, personally and also as a policymaker,” said Brannan. “I am married to a small business owner, my deputy chief of staff is a small business owner, you know, a lot of the kids I grew up with are small business owners in the district, a lot of them. So this is personally important to me.”

There were two main issues brought to the representatives’ attention during the town hall. First was the “bait and switch” that occurred with the Emergency Injury Disaster Loan. Originally, it was advertised as a flat $10,000 forgivable loan to small businesses, but was then changed to a $1,000 per employee loan. So small businesses that had only a handful of employees were expecting $10,000 and now that was severely cut for them.

“They changed the rules of the game…in the middle of the game,” said Randy Peers of the Brooklyn Chamber of Commerce.

The second main issue discussed is how businesses can use and repay the PPP Loan.

“Most businesses won’t be able to exhaust those funds within that time period,” said Peers. This is primarily due to the condition that 75% of the loan must be used toward payroll costs. According to Peers, that won’t work for most NYC businesses as payroll didn’t make up 75% of their costs before the pandemic. He says rent and other overhead costs make up the bulk of local businesses’ expenses.

Despite so many businesses receiving some type of loan, 46% of Brooklyn businesses missed their May rent payments, according to the Brooklyn Chamber of Commerce. So, local businesses are struggling to meet that guideline, said Peers, and if they can’t meet it then they will have to repay the loan within a two-year period rather than having it forgiven.

“The 75/25–I don’t think it fits New York City,” Congressman Rose said about the guidelines.

In addition to providing resources to business owners, local officials are taking action in their respective positions.

Brannan helped pass a package of bills through the City Council on Wednesday to ease the financial burden on small businesses. The package included bills that suspended sidewalk cafe license fees, protected commercial tenants from harassment by their landlords, and put caps on fees for third-party delivery services so they can’t hike fees for participating restaurants.

The idea for that last bill came directly from local business owners who told Brannan that “these guys were killing them.”

Assemblywoman Frontus proposed a “duty to warn” bill in the New York State Assembly, which would require businesses to warn employees of potentially hazardous environmental and health conditions in the workplace.

This bill came as a response to employers like Amazon failing to inform their employees if another employee had COVID-19. “So they didn’t even know that there was a potential for them to be at risk,” said Frontus.

While this is the first virtual town hall that local officials have hosted, they’re hoping it won’t be the last.

“Part of being a leader is knowing when to lead and it’s also knowing when to listen,” said Brannan. “For small businesses we have to stick together, we have to support them because when this is all over our neighborhoods, and frankly, the economy is going to be vastly different.”