It’s Now A Law; Major Property Tax Relief For Seniors & Disabled Homeowners

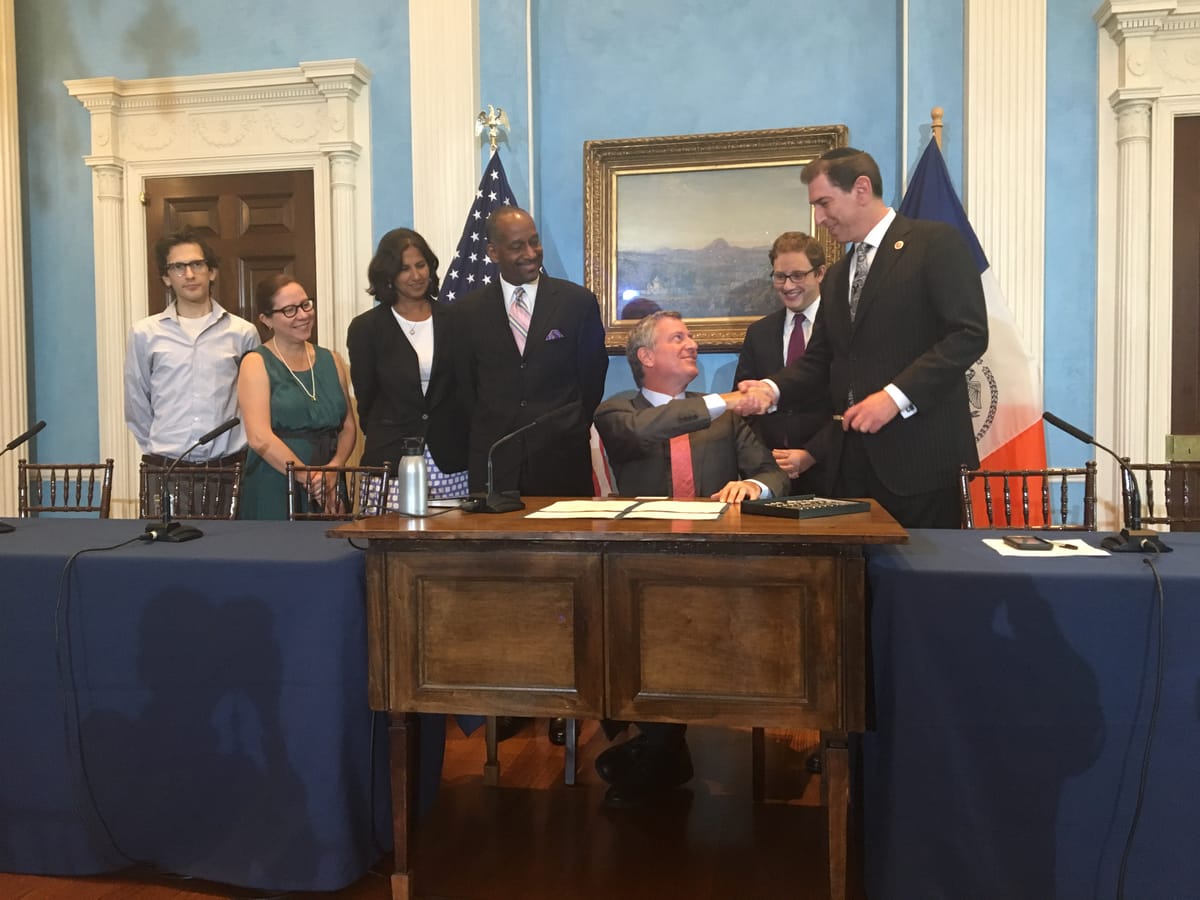

Seniors and disabled homeowners will now get major property relief, as the bill sponsored by Councilman Chaim Deutsch (D-BROOKLYN) to offer a significant property tax benefit to senior and disabled homeowners, was signed into law on August 25th.

It raises the maximum income threshold from the current $37,400 to $58,400, enabling about 32,000 additional seniors and disabled homeowners to qualify for the exemption, resulting in potential savings of up to $1,000 a year for qualifying individuals.

“Today’s bill signing is a victory for tens of thousands of senior and disabled New Yorkers, who will no longer need to make a choice between paying bills and purchasing food or essentials,” Councilman Chaim Deutsch, a sponsor of the bill said. “We are providing a tax break to the most vulnerable in our society – the people who need it the most.”

|

SCHE/DHE at $50,000 |

|

| Income Range | Abatement |

| $57,500-$58,400 | 5% |

| $56,600-$57,499 | 10% |

| $55,700-$56,599 | 15% |

| $54,800-$55,699 | 20% |

| $53,900-$54,799 | 25% |

| $53,000-$53,899 | 30% |

| $52,000-$52,999 | 35% |

| $50,100-$51,999 | 40% |

| $50,001-$50,999 | 45% |

| $0-$50,000 | 50% |

Proposed chart from NYS Senate.

Here’s how you are eligible for the exemption:

- Senior applicants must be 65 years of age or older in the year that they apply. For example, for this year you would need to be 65 by December 31, 2017.

- For DHE, all of the owners must be persons with disabilities.

- If you own your property with either a spouse or sibling, only one of you needs to meet this age or disability requirement.

- The combined income of all owners and their spouses cannot be more than $58,400. Income includes, but is not limited to, Social Security, retirement benefits, interest, dividends, IRA earnings, capital gains, net rental income, salary or earnings and net income from self-employment.

- For senior homeowners: All owners must occupy the property and have it as their primary residence unless:

- One of the owners is a non-resident because he or she is a spouse or used to be a spouse of the resident owner and is not living there because of divorce, legal separation or abandonment.

- One of the owners is absent because he or she is receiving health-related services as an in-patient of a residential health care facility.

- If either of these situations applies, the only person who can reside on the property during that period is the spouse or co-owner.

- For homeowners with disabilities: The property must be your primary residence if you are applying as an owner who is disabled. If you are receiving health-related care as an inpatient of a residential health care facility, your property may also be eligible.

Note: You cannot receive both SCHE and DHE (Disabled Homeowners’ Exemption). If you qualify for both, you will only receive SCHE. To check if you’re eligible for the tax relief, check out our previous article here.