Fed Legislators Hoping To Delay Rise In Flood Insurance Rates As Sandy Anniversary Nears

As the one year anniversary of Superstorm Sandy draws near, homeowners living along the shores are staring down another potential catastrophe, skyrocketing insurance rates. The Wall Street Journal is reporting that if coastal homeowners don’t begin the costly enterprise of elevating their homes, their coastal flood insurance premiums could increase by a whopping 500 percent.

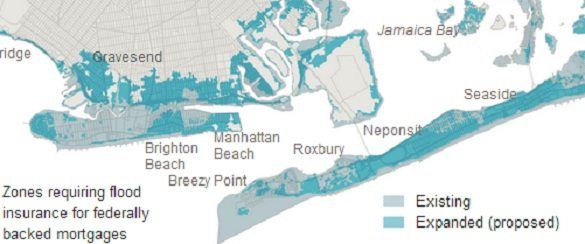

We first reported on the possibly of drastically increased insurance rates in January when FEMA expanded the flood zone lines for the first time since 1983. According to estimates, a $250,000 home with a ground floor four feet below sea level will have to pay an eye-popping $9,500 a year in flood insurance. If the owners manage to (expensively) hoist that home three feet above the flood line will only have to pay $427 a year.

The Journal is reporting that approximately 30,000 homes, now located in the redrawn FEMA flood zone lines, could be faced with paying the high rates in two years time. Many of these homes are owned by middle-class residents and the new rates represent a punishing blow to people already hammered by the winds of Sandy last year.

For its part, FEMA declared that they will undertake an affordability study to measure the economic impact of their redrawn lines. The Journal is reporting that their study will take two years to complete and cost taxpayers $1.5 million to conduct.

In the meantime, senators in Washington are rallying for their constituents, calling for delays to the rate increases until the problem can be fairly addressed. The increased rates are the result of a law, called the Biggert-Waters Act, passed just months before Superstorm Sandy struck. The law renewed the federal flood insurance program, but sought to cut subsidies to the program and force homeowners to pay the rates that reflected the actual risk of living near the water. It was proposed in response to years of concern that the flood insurance program spent taxpayer’s dollars to rebuild vacation homes for the wealthy.

But in New York City, most of the homes in the flood zone were primary residences of middle-class families, unexpected victims of the new law, which passed with support from New York senators Charles Schumer and Kirsten Gillibrand.

Now Schumer and Gillibrand, as well as other supporters of the Biggert-Waters Act, are scrambling to delay the increases, and there appears to be some support from FEMA as well.

In an appearance before the Senate last month, FEMA Administrator W. Craig Fugate said the U.S. should stop subsidizing risk for new construction, businesses and secondary homes. “But I think we need to look at affordability people for who live there, look at how we can mitigate their risk,” he said.

Democratic Rep. Maxine Waters, the Californian who co-sponsored the Biggert-Waters Act, was seeking to delay its implementation, saying in a news release that she didn’t intend for homeowners to face “outrageous” premiums.

Although FEMA says some property owners who lift structures above flood plains could see their insurance rates drop, the Biggert-Waters Act has sparked protests in at least nine states.