Say What You Mean, And Mean What You Say

Telling Tips is a series of articles from local experts to help you save money, make better decisions and plan for a better future.

Both presidential candidates would have flunked my English class.

A couple of weeks ago, President Obama said “You didn’t build that.” Of course he did not mean exactly that. Candidate Romney said “47 percent… pay no income tax.” Of course that is true, but he didn’t mean it in the way it was reported.

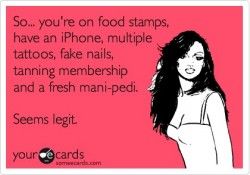

Most of you are hard working and provide for you families, pay taxes, and don’t like the idea that there are a bunch of free-loaders who just collect welfare checks to pay for drugs, buy groceries with food stamps wearing mink coats, or collect 99 weeks of unemployment checks while working off the books. Sure, there’s waste and corruption, but something needs to be done. Can we start with you?

It’s said that “Ninety-nine percent of the lawyers make the rest of them look bad,” so it is that the majority of Americans are dependent, if not at least ‘takers’, from Uncle Sam in the income tax area?

Are you a moocher? Would you give up the help the government gives you for the sake of your country? Would you try to no longer be dependent on Uncle Sam?

Senior Citizens: Social Security is not a tax benefit, but would you give up the extra exemption for being age 65 or over? As well as giving up the credit for the elderly? Didn’t you have enough time over your earnings years to save?

Working Poor: Would you give up your earned income tax credit? Your parents worked to make a better life for you, and you work to make a better life for your children. Maybe go to night school or get a second job and don’t rely on this extra.

Working America: Did you enjoy the two percent Social Security holiday? For the past two years, your Social Security contribution rate decreased from 6.2 percent to 4.2 percent. Was it necessary? Are you ready to give it up?

Child Credits: Would you give up the extra exemption for each of your children? What about the babysitting credit? And the extra earned income credit based on the number of children you have? You chose to have children. Is it the government’s responsibility to decrease your taxes because you now find it hard to manage a budget?

Education Credits: Would you give up the $2,500 education deduction for your child in college? College is not for every kid. Why is your child in college? Would an affordable trade school be better? And why an out-of-area school? Can’t they party enough locally? What about a junior college as a starter? And if they didn’t get good enough marks in high school to be awarded a scholarship, what makes you think they will do any better in another city? And why do you have to pay? It was their choice — you told them.

Home Owners: Would you give up the real estate tax and the mortgage interest deduction? Why should your taxes be reduced for your property ownership? Renters don’t get the same benefit.

Move For A New Job: Would you give up this deduction? If you worked overseas, why are you getting a tax benefit to move back to the United States? You already were excluded from paying some taxes on your earning. And if you move from New York to Pennsylvania, you’re moving for an economic gain. Does Big Brother have to be involved and help you with your move?

Medical Expenses: Would you go it alone? As it is, the high deductible of seven and a half percent of your A.G.I. knocks out most of us from claiming this, but is it needed at all? You can purchase medical insurance, or your employer might provide it, as well as catastrophic and long-term care coverage. You chose not to be covered. Where is your family? Or did they move your assets out of your name so they would have more of an inheritance?

Educators: Would you give up your $250 deduction for supplies? Where is the Parent Teacher Association for your school? You made the decision to buy things from your own resources. A secretary doesn’t get a deduction for buying a notebook because she doesn’t like the one the office provides, a construction worker doesn’t get a deduction for buying some jeans, nor does a manager get a deduction because they have to wear a suit to work. Why you?

Many of us, including myself, are takers — untaxed health care through work, mortgage and real estate deductions, lower taxes on earning from investments. And legally, many pay no income tax thanks to these. And if these benefits are around, I prepare my client’s tax returns to take advantage of every credit and deduction allowed. But are we ready and willing to give these up for the greater good?

Everybody wants tax reform as long as it doesn’t affect them. But it is coming. I don’t believe that this country wants to become socialistic. Therefore,

all of uswill have to sacrifice, no matter who wins the election.

And while we are all hurting, let’s remember that it was Congress who gave away the store.

Have a good week.

Quip: “Remember… Politicians and diapers should be changed often and for the same reason.”

Joseph Reisman, of Joseph S. Reisman & Associates, has been serving tax prep and business accounting expertise from his Coney Island Avenue office for more than 25 years. Check out the firm’s website.